Building upon the November 2021 Citi GPS report Philanthropy and the Global Economy, we are delighted to again partner with Citi’s Private Bank as well as with a group of expert partners to review the latest developments in philanthropy. We address two specific research topics by again conducting an extensive literature review and participating in multiple sessions with expert commentators. We are particularly grateful to the experts listed in the author block of this report for their contributions to our study.

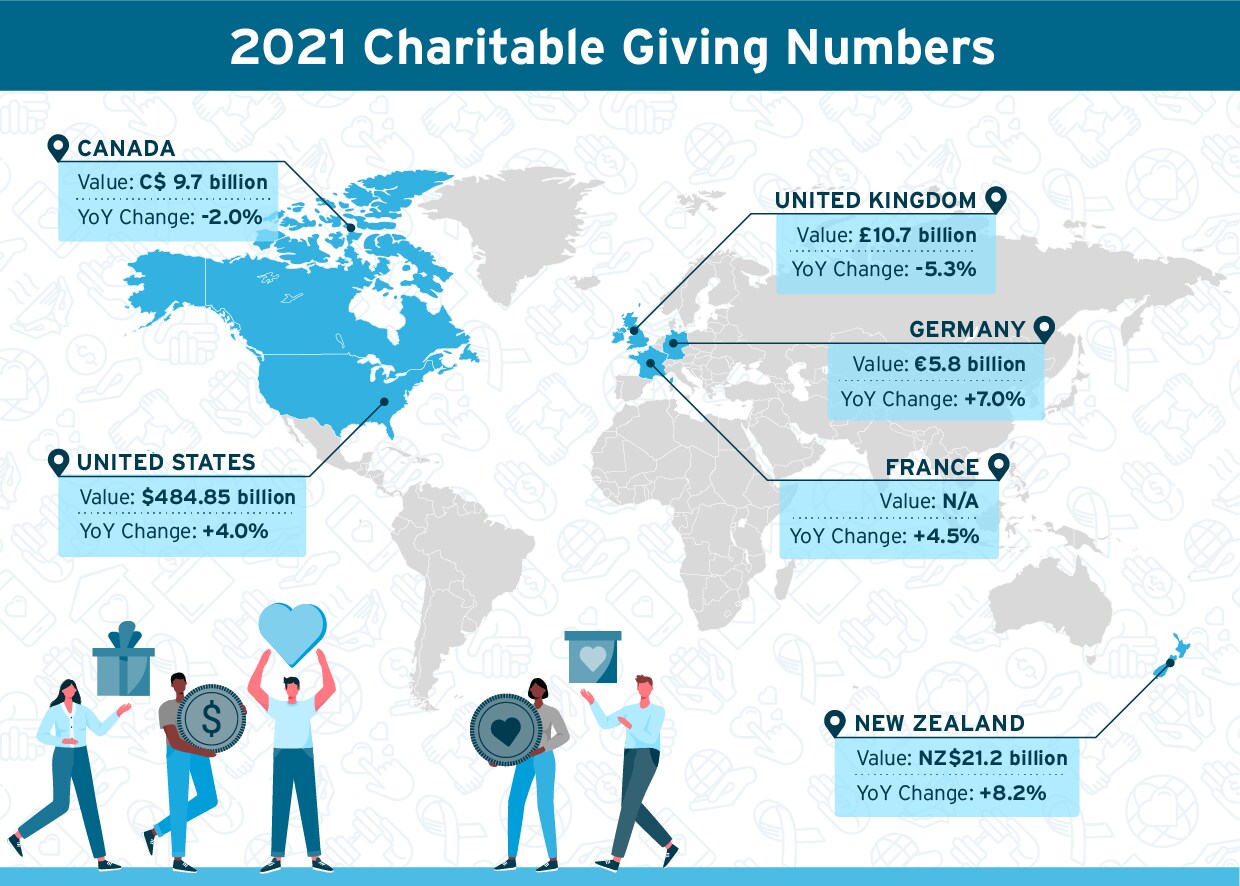

We argued in last year’s report that the scale of philanthropy’s contribution to the global economy needs to be much more broadly recognized, especially within the policymaking world. Many of the world’s greatest challenges can be better overcome by a broader partnership between the public, private, and non-profit sectors. After significant responses to the pandemic and a growing involvement in supporting the green transition, the crisis in Ukraine has provided a fresh and unexpected challenge for philanthropy. The evidence to date is that the Ukraine crisis has led to a very broad and swift philanthropic response. It may also have served to perpetuate some trends seen during the pandemic such as a growth of trust-based philanthropy. There is a very mixed picture across countries as to total philanthropic giving in 2021. It is, however, clear that the very economic conditions that now prompt a greater need for philanthropic giving have historically been a headwind to it. Foundations and charities, in particular, face the new challenge of managing very significant inflation in staff and procurement costs at a time when many of them need to use non-earmarked funds for investment in better technology platforms.

After an overall review of the state of global philanthropy in 2021, we consider in this report two specific developments. First, we examine in more detail how an even closer integration of philanthropy and investment could unlock significant funding for charitable aims. While we have previously calculated the value of monetary donations globally each year as in excess of $500 billion, the non-profit sector also holds significant investment assets and sits on a spectrum that ranges from social enterprises to for-profit companies. We argue that better targeting of the total stock of philanthropy in collaboration with other players across this spectrum, and in pursuit of specific mutual goals, could yield material benefits to economies and societies.

Second, the surge in value of digital assets in 2021 yielded record growth in digital asset giving, with some organizations reporting between a sixfold and twelvefold increase in digital asset donations. While part of this growth was clearly fueled by a remarkable price phenomenon in cryptocurrency, we see certain trends as secular. The emerging field of digital asset giving stands to change the practice of philanthropy, from reducing the requirement for trust between donors and recipients through the use of blockchain, to increasing the transparency of charitable giving. Also, the new digital donors tend to be younger and male, historically a more elusive group for most donor acquisition strategies. One thing is for certain: Foundations and charities need to be digital asset ready.

This new report is the second installment in what we plan to be an annual series conducted in partnership with Citi’s Private Bank and world class experts. We hope this report continues to stimulate a positive debate on how best to maximize the value of philanthropy’s contribution to our world.