The following is a freely accessible summary of a published Citi Research report.

A new Citi Research report from a team of economists and analysts led by Johanna Chua explores the risks that U.S.–China tensions will lead to geoeconomic fragmentation—the disruption of the international flow of goods, services, capital and people. Those flows have arguably been an important driver of productivity growth, fueling gains in efficiency and knowledge spillovers. A recent IMF analysis of de-risking trade between China and the OECD estimates a decline in global GDP of 1.8%, with a 6% decline in GDP for China under a scenario in which manufacturing and sourcing shifts along geopolitical lines, known as “friendshoring.” In a “reshoring” scenario in which China’s manufacturing and sourcing returns within its borders, losses become much larger for the rest of the world, especially for China’s neighboring Asian economies.

Worries about trade fragmentation come at a time when emerging markets have already endured significant setbacks from COVID: The authors estimate cumulative real output losses of about 7.7% in emerging markets, compared with losses of just 1.2% in advanced economies by fiscal 2024.

That said, the authors note that large parts of non-frontier emerging markets have done relatively well in weathering the Russia–Ukraine conflict, the associated surge in commodity prices, and the Fed’s dramatic tightening. Excluding China, Russia and Ukraine, emerging markets’ cumulative output losses were only 1%, compared with advanced-economy losses of about 2.7%. Emerging markets have been bolstered by sound macroeconomic policies and imports of cheaper oil from Russia, and have reduced their external funding gaps and built reserve buffers to manage the aggressive Fed hiking cycle.

But despite this resilience, the authors warn that they see four factors set to worsen the de-risking between China’s sphere of influence and the U.S.-led bloc, which could create more growth challenges for some emerging-markets economies.

Friendshoring is a very slow process

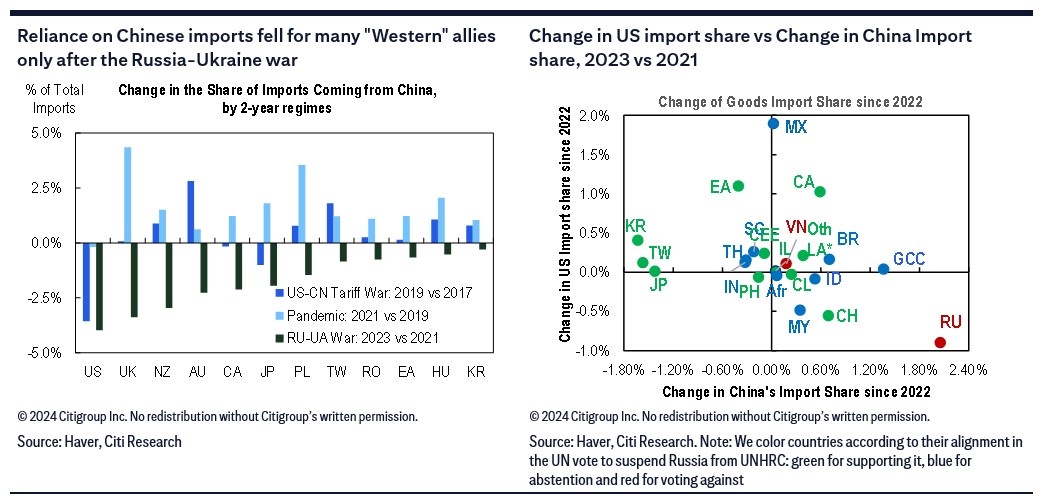

The first factor noted by the authors: Friendshoring is very costly and takes time. Moreover, the initial impetus from heightened geopolitical risks is likely a reshuffling of trade flows and sourcing, rather than significant investments in new capacity. The authors argue there’s no real evidence of material friendshoring in the aftermath of the 2018–2019 U.S.–China tariff war, and even less during the pandemic. It wasn’t until the aftermath of Russia’s 2022 invasion of Ukraine that the calculus about the need to reduce import dependence on China seemed to materially alter, and even then the adjustment proved very uneven.

Friendshoring’s reconfiguration of supply-chain capacity depends on both policies and macroeconomics, and the authors think this trend could intensify in coming years. While noting a pickup in supply-chain relocation announcements toward India and Mexico in recent years, actual foreign direct investment (FDI) flows haven’t seemed to register a notable increase. That said, the authors add a caveat that high interest rates could have acted as a drag on FDI, a situation that could change as more central banks begin cutting rates.

On the other hand, China’s policies are increasing the economic costs of de-risking from China, and this could slow any friendshoring trend. Despite recent years’ weak global goods demand, growth in China manufacturing fixed asset investment was resilient in 2022 and accelerated in 2023, boosted by policies friendly to business and production. China’s unbalanced growth strategy means a significant share of its capacity will be exported, and China’s inflation being so much lower than that of its trading partners means its real effective exchange rates have sharply depreciated since mid-2022. To summarize, it’s hard to beat China’s cost competitiveness absent a push from the U.S.-led bloc to really increase the costs of operating there.

Ultimately, the authors note, friendshoring of supply chains looks far easier for the U.S. than China. China lacks high-tech “friends” that could compensate for reduced reliability of sourcing high-tech products from the Western bloc.

That brings the authors to their second factor to consider. They believe China will keep doubling down on industrial policies, and Western bloc countries will also increase their own implementation—witness the U.S. and 2022’s Inflation Reduction Act and Chips and Science Act. While such policies can spur innovation, many of them have protectionist elements. The authors note semiconductors as a case in point, with the U.S. tightening China’s access to critical chip technologies and China reportedly asking top telecom carriers to phase out foreign processors in their networks. The U.S. is pursuing an aggressive reshoring strategy for chip production, aided by significant subsidies; the authors note that since South Korea, Taiwan and China combine for about 70% of global semiconductor production, U.S. gains in production share could put local job creation and associated domestic capex by South Korea and Taiwan at risk. Sizable government subsidies could also complicate the supply-demand rebalancing of semiconductor business cycles, making the industry even more volatile and whiplashing economies particularly tied to semis.

What a Trump win could mean

A third factor is the possibility of former President Trump winning another term, which the authors think raises the specter of a much broader approach to tariffs and export controls. While seeing Trump as unlikely to reverse Biden’s export controls on China, the authors note he’s publicly floated a 60% tariff on Chinese imports and 10% across-the-board tariffs. But they also note considerable uncertainty around Trump’s trade policy.

A favored Trump metric in driving trade policy appears to be the U.S. trade balance, and key targets of U.S. trade-policy tensions could be China, the EU, Mexico and possibly Vietnam.

China will likely be the target of the most punitive trade measures, the authors predict: After all, it’s the largest contributor to the U.S. trade deficit and its strategic revival. But the authors see Trump’s proposed tariffs more as bargaining chips; 15% tariffs with some trade diversion strikes them as a more likely outcome. China’s options for retaliation strike the authors as very limited, beyond letting the renminbi depreciate; targeting U.S. multinational corporations in China seems unlikely, for fear that it would backfire.

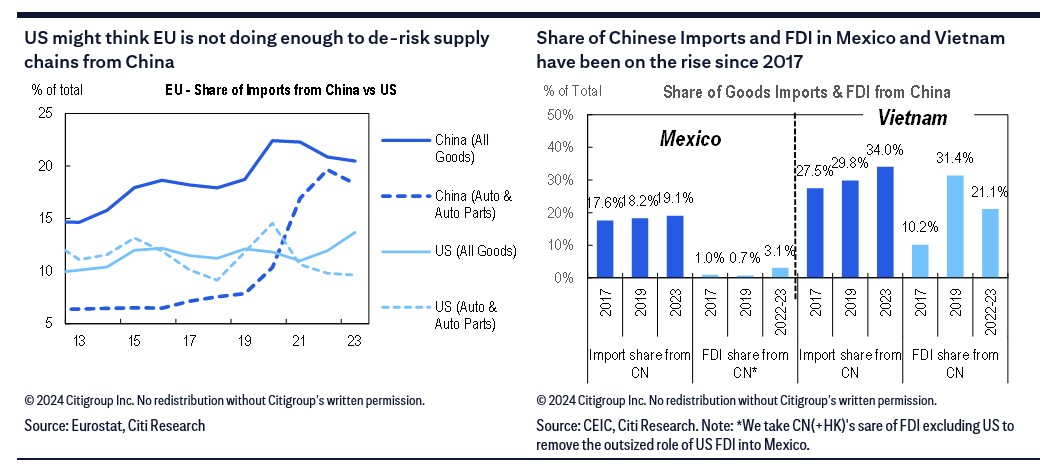

The EU could be a Trump target due to long-standing grievances including a digital services tax and market access; another issue is EU trade restrictions on Chinese goods and investments and divergence from the U.S.’s position.

When it comes to Mexico and Vietnam, the authors note some evidence that China exports to the U.S. are being rerouted through third countries, which undermines de-risking, let alone “strategic decoupling.” Mexico and Vietnam could therefore attract U.S. scrutiny.

A fourth factor: The authors think the EU will harden its trade stance on China. The EU, they note, is a key battleground for geoeconomic fragmentation: As a bloc, it’s the largest trading partner of both the U.S. (18.5% of total goods trade) and China (13%). Despite a political alliance with the Western bloc, the region has only made a marginal shift in its reliance on Chinese imports, with the share of imports rising in recent years for some key products.

The authors think European officials will push back on Chinese trade in coming years. China’s focus on industrial upgrades is putting industries in the EU at a disadvantage, and there’s increased recognition that China’s unbalanced growth strategy and consequent excess capacities are a much more systemic problem for the EU.

That said, the authors think the EU’s strategies to de-risk trade will be targeted and slow, in part because the EU Commission lacks the executive powers of the U.S. presidency. China also needs the EU as a key market for its “strategic emerging industries”—green goods—and stands to lose out economically from increased barriers. In the authors’ view, this would jeopardize the big bet made by China’s leaders on high-tech manufacturing as a source of growth; demand from domestic sources and the Global South will likely be insufficient to absorb China’s growing industrial capacity. That suggests there’s room for China to negotiate and appease EU concerns; one obvious concession would be to facilitate more Chinese greenfield investments in the EU, shifting production of these “strategic emerging industries” to Europe.

Existing Citi Research clients can follow this link to access the full report, which also includes a rundown of other potential policy issues in a Trump 2.0 presidency, suggestions for investors, an exploration of China’s capacity conundrum, and local markets updates.