A new Citi Research report finds that the global economy grew 2.7% last year, just below trend and far stronger than projected at the start of the year. That’s another example of the remarkable economic resilience shown over the past several years. But a team of Citi economists and analysts led by Global Chief Economist Nathan Sheets thinks the tide is soon to turn, with growth slowing to around 2% in 2024.

That aggregate outcome is unlikely to qualify as a “global recession,” but growth should be distinctly slower than in 2023. The authors see several factors contributing to this slowdown, ranging from the effects of monetary policy and moderating consumption to a loosening of the labor market and the effects of less-supportive fiscal policies from countries.

Global inflation prospects

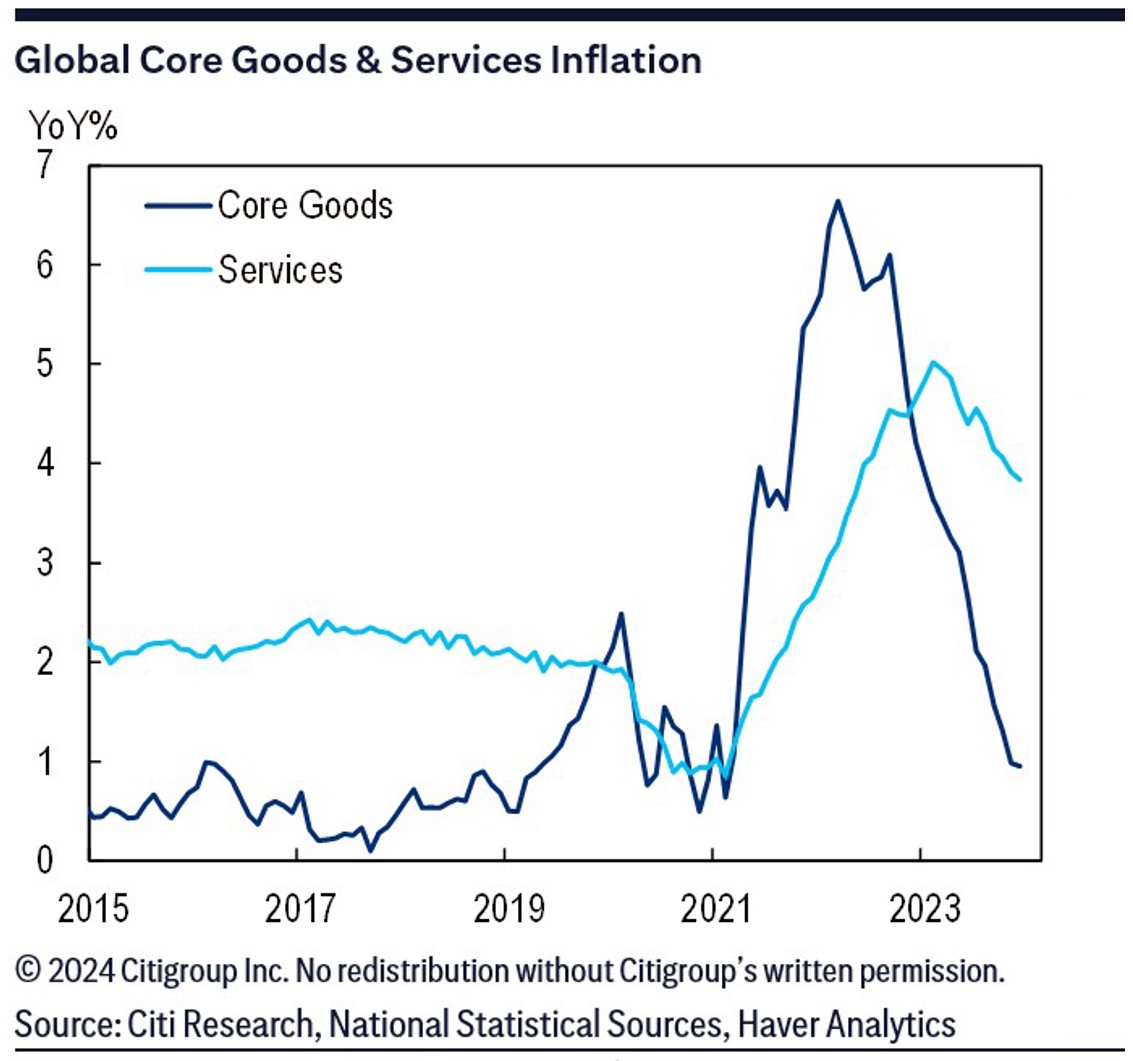

The report describes global inflation as continuing along the broad contours that have prevailed over the past year or so: Global headline and core inflation have both moderated significantly since 2022, but the decline in headline inflation has been much sharper and more pronounced than core inflation’s more gradual retreat. Core goods inflation has fallen sharply amid healing supply chains and softer goods demand than what was seen during the pandemic, but services inflation’s decline has been limited by tight labor markets and persistently high wage growth.

Labor markets have been particularly resilient and a key source of economic strength, but the authors anticipate labor markets loosening as 2024 progresses. That, in turn, should support central banks’ efforts to blunt services inflation and reduce core inflation. The authors expect progress to be relatively rapid in the euro area and the UK, with Australian inflation declining more gradually and labor-market tightness limiting progress for the U.S. All told, the authors project global headline inflation will retreat from 4.7% in 2023 to 3.3% this year, just slightly above its 3% historical average.

China’s weak inflation performance is worrisome, however, given its important role in the global economy. China’s PPI inflation has been in deeply negative territory since late 2022, the product of a “perfect storm” of moderating commodity prices, weakness in global demand for Chinese exports, and softness in the domestic economy.

The authors project that China’s headline CPI inflation will rise back to near 3% this year, but caution that risks to this forecast are heavily skewed to the downside. Disinflationary impulses in China may prove stronger than currently assessed, and it’s not clear to the authors that Chinese authorities are prepared to address the challenge should disinflation prove more entrenched than expected.

Central bank policies

The report notes that the risks to global inflation now look increasingly two-sided: Inflation might once again prove more stubborn and entrenched than central banks believe, but downside risks are also coming into view. Besides China’s challenges, there’s a risk that central banks will keep monetary policy too restrictive as they seek “confidence” that inflation is sustainably lower, leading to downside growth surprises and a decline in inflation that’s sharper than desired.

The authors expect central banks will cut policy rates, but do so cautiously and with the risk of stickier inflation in mind. The authors see developed markets’ major central banks as likely to begin cutting during the second quarter, with further cuts as the year progresses, and they continue to project a U.S. recession, likely around midyear, which will spur additional second-half cuts from the Fed.

The authors also see rate cuts coming from the ECB, the Bank of England and most other developed-markets central banks. Many emerging markets’ central banks, on the other hand, raised rates aggressively through the pandemic, allowing them to cut rates earlier than their developed-markets counterparts. Emerging-markets countries are now increasingly debating how sharp their easing cycles should be. Emerging Asia didn’t see the same rapid inflation as elsewhere in the world, and so those central banks’ hiking cycles were more muted, which should lead to more gradual rate cuts.

Key risks

Beyond global inflation, the authors see further risks and challenges for 2024. Geopolitical headwinds continue from the Russia-Ukraine conflict, and Middle East tensions have created another source of concern, with challenges emerging for global shipping. But the authors note that the upward moves in shipping costs are only a fraction of those seen during the pandemic. While these developments require careful monitoring and assessment, the authors’ conclusion is that at least so far they’re not game changers for the global outlook.

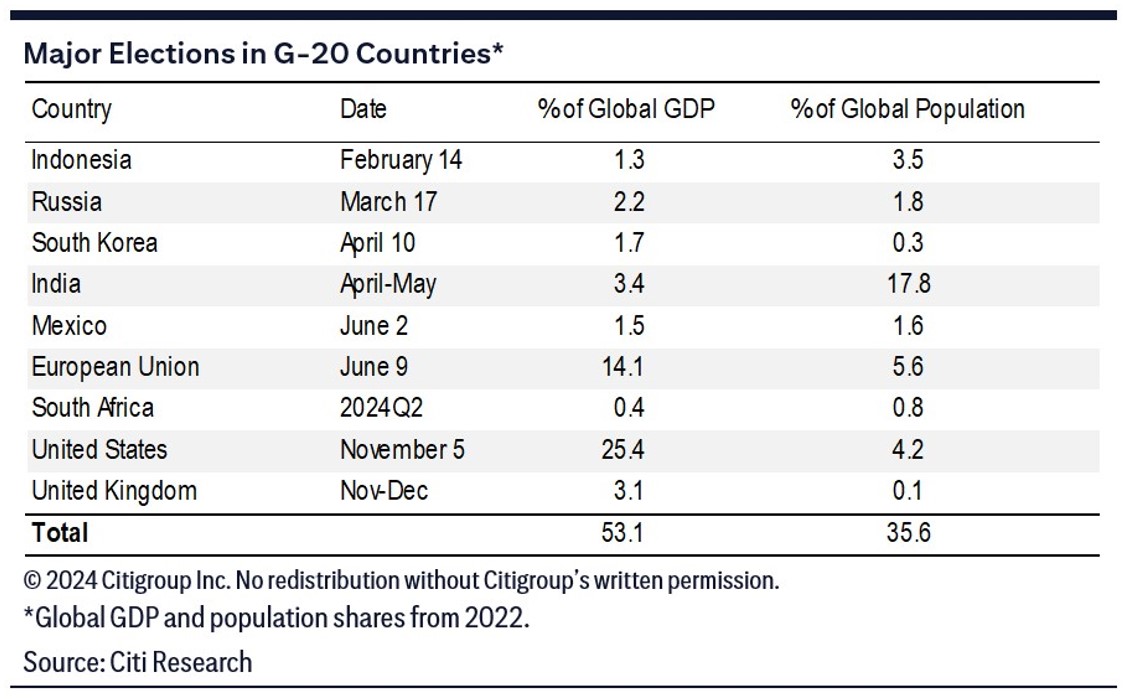

Another source of uncertainty comes from dozens of national elections on tap for 2024. The one that looms particularly large for markets is November’s U.S. elections, which are poised to be close and hard fought. The authors note that the ebb and flow of that campaign is likely to stoke volatility in global markets, particularly in the second half of 2024. Other risks of note include high public debt levels, the vulnerability of U.S. commercial real estate and the banking sector’s exposure to it, and valuations in many asset markets that strike the authors as optimistic.

But the authors close by noting wryly that economists are paid to worry. Despite an abundance of concerns, they observe that the global economy to date has generally surprised on the upside with its sustained resilience. On a host of fronts, they see 2024 as likely to be a year that rewards tactical flexibility rather than deep conviction.

Existing Citi Research clients can follow this link to access the full report, which also includes country-by-country analysis and investment-strategy discussions for equities, commodities, rates and foreign exchange.