A recent Citi Research report from a team led by Global Chief Economist Nathan Sheets looks at the dynamic interplay between two competing perspectives shaping the global economy. The first perspective is the drive toward deeper and more extensive economic and financial integration, policies that were championed in the years before the Global Financial Crisis (GFC) and that largely fulfilled their promise, lifting growth and restraining inflation. The second perspective is the political opposition to that drive, with criticisms ranging from globalization’s gains not being shared equitably to open economies’ vulnerability to global shocks.

The discussion is organized around 12 questions examining key elements of the globalization debate, with the authors’ conclusions.

1. What were the key factors driving global trade growth and deepening integration more generally through the 1990s and the 2000s (before the Global Financial Crisis)?

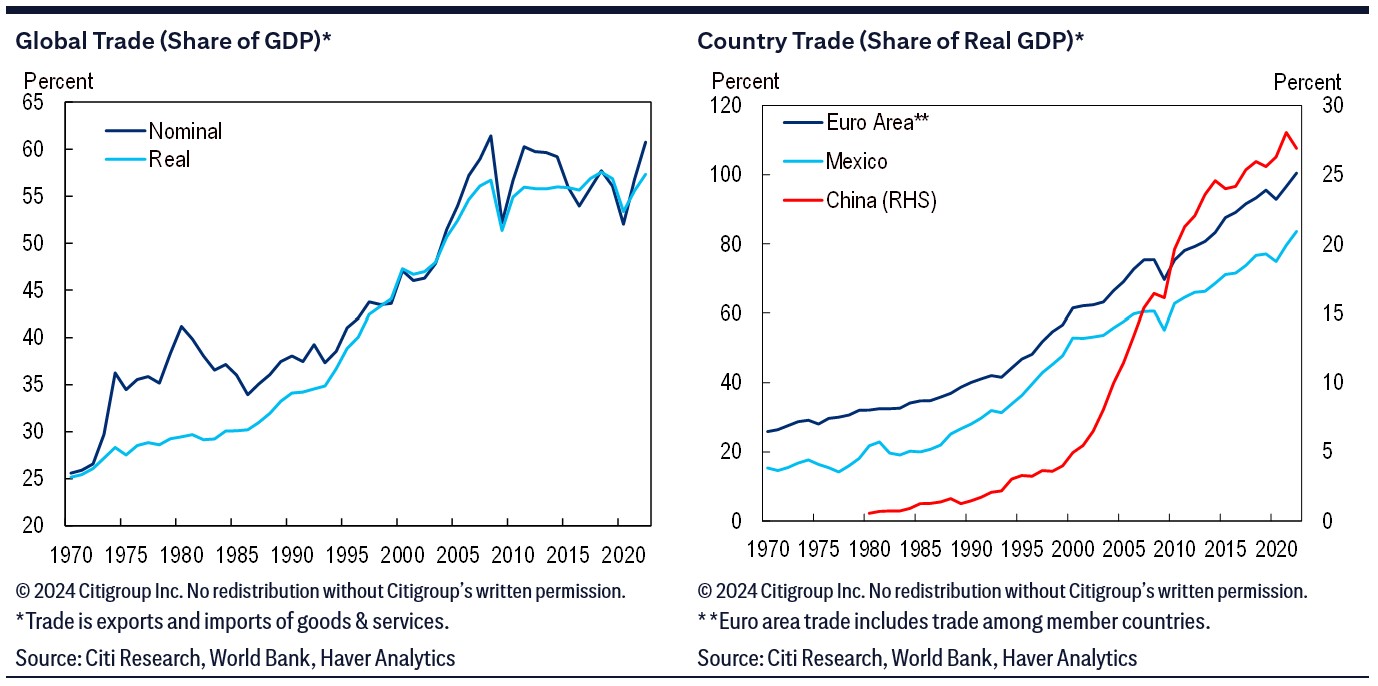

The report notes that global trade rose from 40% of global GDP in 1995 to 55% in 2005. That was driven by multiple factors: China’s increasingly significant role as a global exporter; the deepening integration of European trade and markets under the auspices of the EU; diversification of global supply chains (which particularly benefited China); and most broadly, a strong consensus for globalization and free trade.

2. Why did the pace of trade expansion slow so sharply after the Global Financial Crisis? What were the key headwinds and criticisms that emerged?

Trade’s share of GDP leveled off in the years before the pandemic, for multiple reasons. The authors note that during this period many of the factors that supported the surge in trade ran their course. The global diversification of supply chains slowed significantly, with China in particular moving to internalize production. Following the GFC, global investment was surprisingly muted. And the global consensus in favor of free trade and globalization was increasingly called into question, with a populist backlash manifest in the UK’s vote to leave the EU and President Trump’s tariffs on China. In many countries, criticism came that globalization’s benefits hadn’t been shared broadly and equitably. The pandemic raised further questions about the wisdom of globalization, with policies in some countries to foster domestic production and resist trade dependencies in key industries.

3. How has global trade performed since the onset of the pandemic? And what is the outlook for global trade through the decade ahead? Is trade growth likely to match or even outpace GDP growth?

Global trade quickly bounced back from the weakness seen in 2020; as the report notes, there was a surge in demand for goods, followed by consumers rotating powerfully into services spending as they looked to make up for experiences foregone during COVID. The authors expect services spending to normalize in the coming year, with some accompanying recovery in global goods sectors that will carry over into international trade.

The authors’ best guess is that long term, global trade will expand at roughly the same pace as global GDP, as was the case before the pandemic. But there are downside risks to be noted. For instance, the pandemic’s severe supply-chain disruptions and surging transport costs have prompted firms to re-evaluate the wisdom of broad, geographically diversified sourcing networks (especially ones centered in China) and consider bringing supply chains closer to home.

4. In what ways will the supply-chain disruptions endured during the pandemic influence sourcing and production strategies going forward? What does this mean for the contours of globalization?

The authors write that the pandemic’s supply-chain disruptions came as an unexpected challenge for many manufacturing firms; pre-COVID, the consensus was that supply chains were optimized and functioning smoothly, with firms having solved the riddle of how to keep inventories lean while ensuring a reliable flow of inputs for use in production. With those assumptions having been undercut, the authors’ sense is that firms are likely to take more precautions to fortify their inventory-management practices, such as by shifting to a more geographically diversified mix of suppliers, with reliance on China a particular concern. Such shifts may include sourcing inputs closer to home, known as near-shoring. It’s also plausible that we’ll see re-shoring, in which an increased share of production is brought home entirely.

But the authors note those possibilities must be weighed against the reality that firms have sourced in China for a reason: its unique mix of cost-effectiveness, production flexibility, large manufacturing ecosystems and excellent infrastructure. The authors aren’t seeing a mass exodus from China and don’t expect one. But firms are pursing a variety of strategies, with holding larger inventories a common approach—shifting from “just in time” to “just in case.” A key question: How big a premium will firms prove willing to pay during normal times to have more reliable supply chains during times of stress?

5. More specifically, what countries and regions are the winners and losers in the post-COVID rebalancing of trade, investment flows and supply-chain reconfiguration? Is a wave of “friend-shoring,” “near-shoring” and “re-shoring” likely to trigger a mass exodus of foreign investment from China?

Post-pandemic, the global economy has seen meaningful shifts in trade and investment patterns—the authors note that China’s share of U.S. trade has fallen to its lowest level in more than a decade, with Mexico and other Latin American countries increasingly looking like beneficiaries. The report also notes evidence of both re-shoring and near-shoring occurring at significant scale, spurred in part by U.S. fiscal policy.

While the authors don’t envision a large-scale departure of existing foreign investment in China, investment in additional sourcing is seen increasingly considering other sites in Asia, or moving sourcing and production closer to home. Asian economies are likely to continue benefiting from “China Plus One” strategies, with ASEAN countries looking set to gain more prominence in technology supply chains and India making impressive gains in cellphone manufacturing. Near-shoring should continue to bring benefits to Latin America and economies in central and eastern Europe.

6. How does the growth of trade in services and other intangibles compare with the growth of goods? What’s the outlook for invisibles?

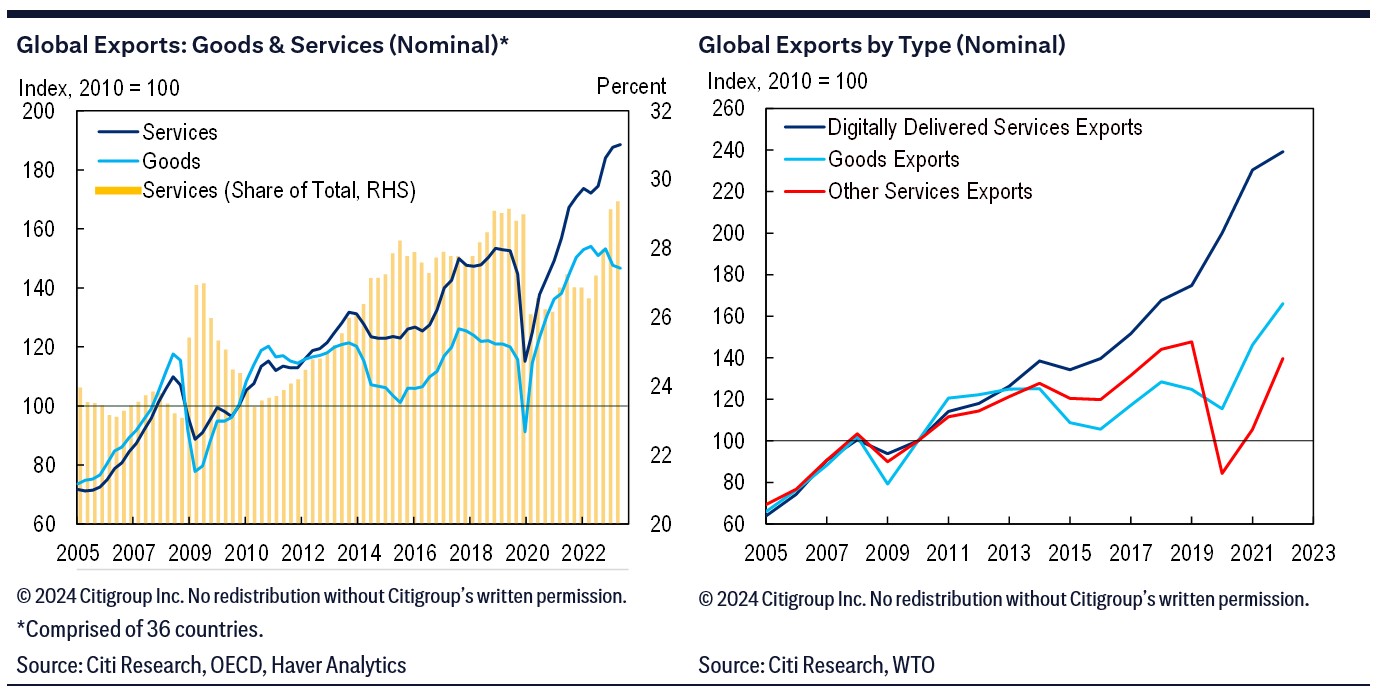

The report notes that the past 20 years have seen global services trade rise from roughly $3 trillion in 2005 to more than $7.5 trillion last year. Meanwhile, trade in digitally delivered services has grown rapidly since the GFC, far outpacing trade in Other Services. Stepping back, trade in all types of services has risen from just under 24% of total global trade before the Global Financial Crisis to nearly 30% of total trade in the most recent data.

The authors interpret the sharply rising trajectory of trade in digitally delivered services as both a signal of globalization’s depth and a driver of further globalization ahead. In their view, this uptrend reflects the need for people around the world to communicate and exchange information as trade, travel and financial flows continue to expand. It also reflects technology’s advance, with AI’s rise likely to accelerate this trend. The authors see this aspect of globalization as likely irreversible, given its close ties to advancing technology and people’s desire to learn, travel, communicate, interact and exchange ideas and perspectives.

7. How important are tourism flows for the global economy and trade? Are they likely to be constrained by the deglobalization pressures we’re seeing around the world? Or is this likely to be a dynamic component of global trade, given the potentially strong demand from the growing population of retirees?

Global services trade has expanded in part because of the growth of tourist flows, the authors note. The pandemic weighed heavily on international travel; while tourism has recovered rapidly, global tourism exports in U.S. dollars remain around 5% lower than 2019 levels, and there are still sizable differences across regions, with travel to Asia having seen the smallest recovery.

Looking longer-term, the authors note tourism flows will be shaped by a number of factors: aging demographics, the evolution of business travel, geopolitical tensions and deglobalization pressures, and a growing global middle class. The authors see that last factor as a sign of untapped demand that’s likely to overwhelm headwinds for the sector: Only 3% of India’s population has traveled internationally, compared with around 76% in the U.S.

8. What are some key trends you’ve seen in recent decades in the global flow of capital? Do you expect capital flows to slow down or accelerate in coming years?

The authors note that deepening financial integration has been another defining aspect of the globalizing economy; 2022’s BIS Triennial Survey found turnover in the foreign exchange market averaged $7.5 trillion a day, roughly double what was seen in 2007. They also note that global capital flows have seen significant variability in recent decades, rising and falling (sometimes sharply) in step with the pace of global economic activity, risk appetite in financial markets and a range of policy constraints. While cautioning that forecasting the trajectory of financial flows is challenging, the authors observe that it’s hard to be optimistic with the geopolitical climate likely to remain fraught.

9. How has the international “reserve currency” role of the U.S. dollar changed over the past few decades, including its use as an invoicing currency for global trade? How will the dollar’s international role evolve through the decade ahead?

The authors note a recent Fed paper’s conclusion that over the last two decades, the dollar has remained the dominant international currency, with its role remarkably stable. International usage of the renminbi has risen, but remains below that of the Japanese yen and the British pound and substantially below that of the euro. The authors strongly expect the dollar to remain in its leading role at least through the coming decade and likely well beyond. Why does the world prefer the dollar? The U.S.’s deep and liquid capital markets have no rival; the world is familiar with the USD ecosystem, from financial markets to the legal and policy environment and regulatory framework; the Fed has shown itself willing to step up and act as a global lender of last resort; and no other major currency seems positioned as a serious challenger.

10. Is the increased reliance of the U.S. on economic sanctions a meaningful threat to the dollar’s reserve currency role? As a corollary, do these sanctions pose risks of increased fragmentation of the global economy and financial system across geopolitical blocs? How significant are these risks?

In recent years U.S. authorities have turned to economic sanctions as a flexible and sometimes powerful way to respond to international challenges. Such efforts ultimately derive their power from the widespread international use of the dollar, the scope of the U.S. financial system and markets, and the size and attractiveness of the U.S. economy. Being banned or restricted from the dollar ecosystem, the authors note, is a painful penance.

Sanctions have attracted controversy, starting with the question of whether they inappropriately “weaponize” the dollar’s reserve-currency status. The risk is a fragmentation of the global financial system, which the authors acknowledge while seeing such problems as more hypothetical than actual. Another concern is extraterritoriality—that firms and individuals from non-sanctioned countries could face penalties if they don’t abide by U.S. policies.

11. Immigration and flexible movement of the world’s labor resources is another potential dimension of global integration. Are the headwinds facing immigration likely to ease during the coming decade, especially given the labor shortages and other challenges arising from aging populations in many countries?

The pandemic significantly disrupted global migration flows, with permanent migration to OECD countries falling nearly 30% in 2020 from the previous year’s level. The last few years, though, have seen a rebound. The authors note a catch-up effect is at work, but so is a surge in refugees and asylum seekers and elevated demand for foreign labor amid broad-based labor shortages. (The authors note the latter has helped ease inflationary pressures.) Going forward, the authors see such labor shortages persisting as populations continue to age.

For much of this cycle, high-income countries have accommodated high migration flows, but in countries such as the UK and Canada immigration policy is being tightened, and migration through the U.S. southern border has generated a heated debate.

12. Bottom line, how would you characterize the prospects for globalization during the coming decade? What key forces will be in play? What is the likelihood of full-blown deglobalization?

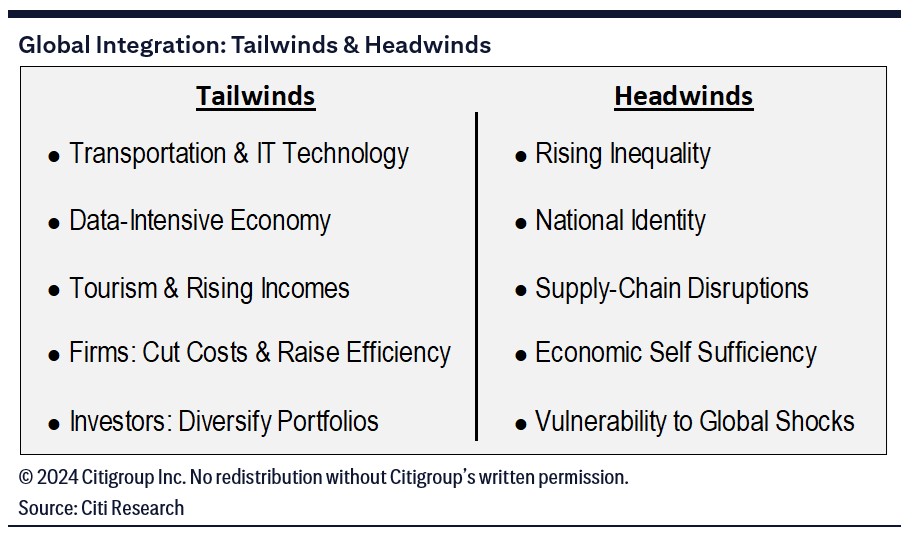

The authors note that globalization is being buffeted by a range of headwinds, but some important tailwinds are in play as well. Their bottom line: The unrestrained globalization of the late 1990s and 2000s is behind us and now even looks naïve, but they’re skeptical that the process will be thrown into reverse. Instead, they expect, globalization will be more measured than in recent decades, as well as more circumspect and cognizant of potential pitfalls and unintended consequences.

The major headwinds include increased inequality, issues around national identity, and a reconsideration of global supply-chain management, with many countries concluding that their governments must be more aggressive in protecting domestic “essential security.” The authors note that some observers of the GFC and the pandemic have drawn the conclusion that a globalized economy will see more frequent shocks, with a shock anywhere quickly becoming a shock everywhere. The authors acknowledge the logic of that argument, but also posit that global linkages can help mute domestic shocks: A weakening domestic economy may be supported by stronger demand, for instance.

These headwinds are very much in play, the authors agree. But they also see some comparably powerful tailwinds. Why did globalization arise in the first place? The authors’ answer is that it rose almost inexorably from advancing technologies, a desire for increased efficiency among firms and investors, and people’s deep desire to learn, explore and improve their lives.

Rather than ask if globalization can be reversed, the authors propose what they see as a better question: What should globalization look like? The authors believe the globalization that will emerge in answer to that question will be more mature and compelling, more mindful of issues of distribution and equity, and reflect tough economic lessons learned. This more mature globalization, they conclude, will be designed to avoid some pitfalls that have been seen while better harvesting important potential benefits.

Existing Citi Research clients can follow this link to access the full report.