The following is a freely accessible summary of a published Citi Research report.

A new Citi Research report looks at the state of the electric vehicle (EV) market in the U.S. and other regions, delving into key debates, exploring new survey insights and offering revised global demand forecasts.

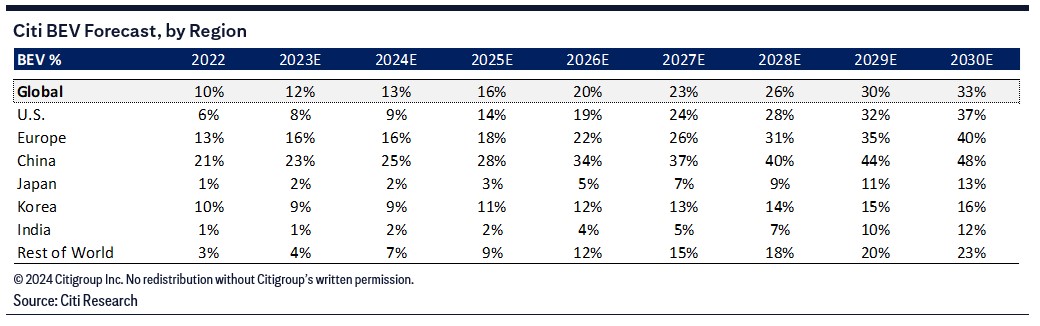

The report, written by a team of analysts led by Itay Michaeli, forecasts global battery electric vehicle (BEV) volume will grow a modest 12% this year, with regional growth ranging from –1% in Europe to +6% in China and +26% in the U.S. Global penetration is seen rising to 13% this year from 12% in 2023.

That forecast, the authors note, is more conservative than the latest one from Standard & Poor’s. But the authors expect growth to accelerate starting next year, with annual penetration gains returning to the 3- to 4-point range. Such a pace would lift global EV adoption to 33% by 2030, with the U.S. at 37%, Europe at 40% and China at 48%.

In discussing key themes, the authors see current EV sentiment as too negative, and think there’s scope for sentiment to improve this spring and summer. Outside of China, meanwhile, the EV slowdown is supporting a narrative about a comeback by “traditional” original equipment manufacturers (OEMs).

For China, the authors remain constructive on BEV sales growth through 2030, but note that through 2026 demand growth will likely be stronger for plug-in hybrid electric vehicles (PHEVs). Europe’s BEV transition strikes the authors as a negative in absolute for all European OEMs, but they think more expensive branded BEVs will likely be less loss-making than cheaper branded BEVs.

The U.S. story

So what happened to EV adoption in the U.S. in 2023? The authors note that on the surface it looks like adoption continued to progress, with new sales penetration rising close to ~8%. But things look different when one takes into account the price cuts and Inflation Reduction Act (IRA) benefits needed to achieve that penetration. Price differentials failed to disrupt the still-strong market for vehicles using internal combustion engines (ICE) or to drive EV penetration meaningfully higher, a “rather disappointing outcome” that has raised questions about the industry’s ability to drive growth amid poor and declining EV profitability, increased pricing pressure and previously planned investments being pared back.

In analyzing what went wrong, the authors largely dismiss some common theories. Was the pressure on EV penetration simply a function of macroeconomic forces? (“Perhaps to some extent.”) Did EV demand suddenly take a turn for the worse? (“Not visibly.”) Are we seeing signs of buyers’ regret with EV owners? (“Not really.”)

Instead, the authors see the softness more as a function of current EV market dynamics, to an extent greater than commonly appreciated. They note the importance of understanding that the U.S. EV market is uneven, with trends often reflecting specific circumstances around a handful of vehicles—seven nameplates account for around 70% of total sales. The authors acknowledge EV adoption “pain points” such as charging and pricing, but see 2023’s EV problems as more vehicle- than market-specific. Such issues can be magnified by recent years’ regional concentration of EV demand: States comprising ~30% of new vehicle sales accounted for ~60% of EV sales. The authors’ takeaway from these vehicle-specific problems is that many of the “old” rules around consumers’ buying habits remain unchanged in the EV era, with a car still an emotional purchase and issues such as saturation and product age able to affect demand more than other factors, including price.

The authors also think the initial wave of EV demand was over-indexed to specific cohorts and age groups where demand may be more exhausted now. That, they observe, isn’t necessarily a bad thing: The authors think about 70% of EV buyers added an EV to their household fleet, making the first wave of such sales effectively an expansion of the new vehicle market and less about EV adoption. A potential lesson: EVs need to have a distinct and compelling value proposition beyond just being EVs, another example of the tenacity of “old” consumer-buying rules.

The authors characterize the U.S. EV market as having entered an “air pocket,” but acknowledge adoption challenges, which range from regional demand imbalances and narrowing the monthly payment gap with ICE vehicles to charging and infrastructure and a perceived political divide. The authors see the political discourse around EVs as arguably the biggest near-term risk to their 2024 demand forecast, but they don’t see that issue—or any of the other challenges facing EVs—as structural.

Vehicle density and other considerations

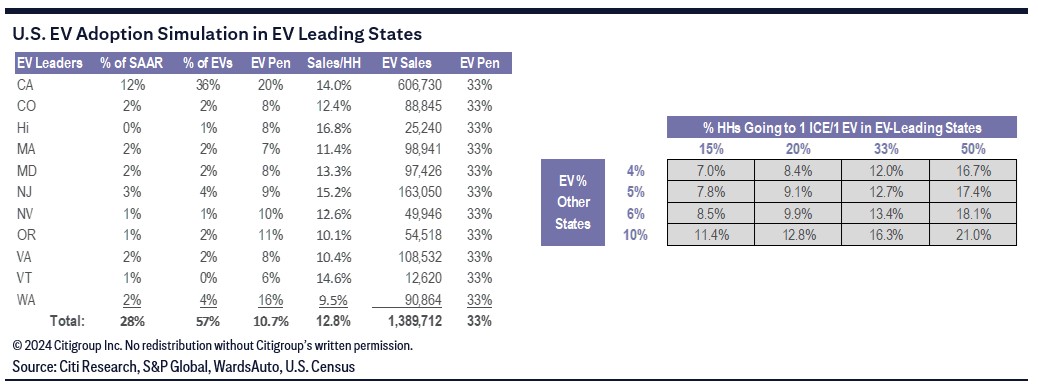

The note sees the U.S. as structurally well set up for potentially rapid EV adoption because it averages almost two vehicles per household. The cost-benefit ratio of EVs is more favorable for two-car households, since EV pain points are less of a factor; should consumers rapidly opt to become a one ICE, one EV household, EV demand could rise overnight. That consideration alone, the authors note, is an argument against taking an overly bearish view of U.S. EV demand.

A challenge in modeling the next wave of EV demand is uneven regional adoption: The authors contend that 11 states, led by California, can still drive growth by themselves under certain assumptions. For instance, if 33% of households in those 11 states transitioned to the “one ICE, one EV” model, 15 million EVs would need to be added.

The authors also explore the effects of IRA tax credits. Tighter eligibility rules mean fewer vehicles qualify for the credit, but the list of qualifiers could grow through 2024 as companies seek to become compliant. IRA point-of-sale credits should help EV monthly payments converge with payments for ICE vehicles, with the gap almost fully narrowed if gas and maintenance savings are taken into account. Additionally, several states offer their own EV incentives and lower battery costs should support a reduction in EV prices.

Another factor that could help unlock demand is improving charging ability, a pain point for potential EV buyers. Most OEMs are transitioning from Combined Charging System (CCS) connectors to North American Charging Standard (NACS) connectors in 2025, which will let consumers use charging stations with NACS ports. That, combined with other charging improvements, should help unlock regional demand.

Automakers have throttled back EV investments, but the authors view that decision as more of a mark-to-market exercise than a strategic shift. While EV expectations have been reset, the authors still think automakers have motivation to pursue EV volume growth. They also expect advanced driver assistance systems and automated vehicles to drive a shift toward revenue streams from software and artificial intelligence, with this transition encouraging OEMs to build an installed base.

Citi’s EV penetration matrix

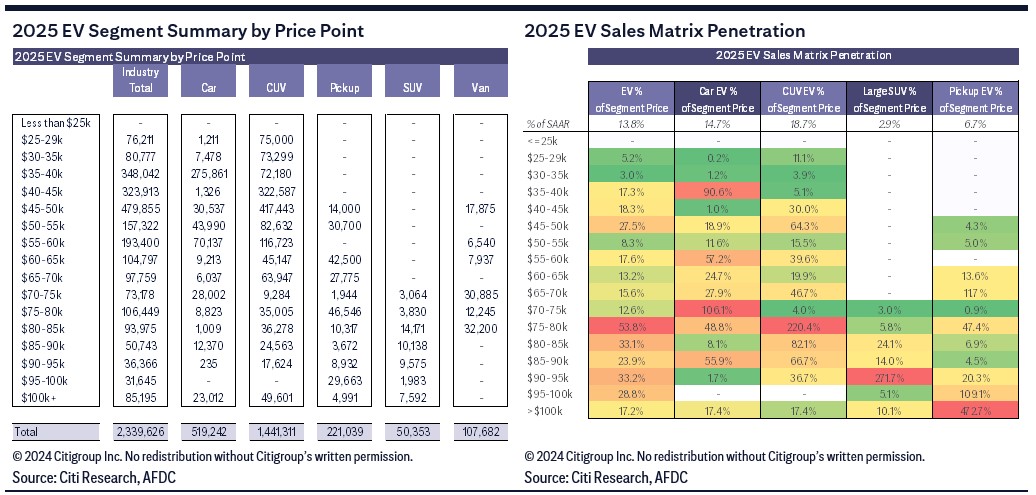

The note makes use of what the authors see as an ideal way to assess EV adoption: Citi’s newly unveiled EV penetration matrix. It works by analyzing new sales penetration across major segments at individual price bands—e.g., SUVs in the $40,000–$45,000 range—and measuring other important metrics through proprietary tracking methods.

Applying the matrix to their 2024–25 EV sales forecasts, the authors forecast 1.47 million units of new EV sales, or 9.1% penetration in 2024. For 2025, the forecast is for 2.34 million units, or 13.8% penetration.

Could PHEVs or extended-range EVs (EREVs) have a greater role to play? The authors think that’s possible: PHEVs and EREVs can be viewed as an investment in future EV share, with automakers’ investments in these models facilitating consumer migration to EVs and ultimately greater long-term EV market share. The authors also note that PHEVs and EREVs could address the economic challenges posed by some vehicle segments, such as full-size pickup trucks. And PHEVs’ popularity in other regions, such as China, suggests untapped demand.

The authors’ advice for “legacy” automakers? Don’t retreat from the EV race, but do adjust.

They note that it’s important for automakers to properly plan and time EV capital deployments to best ensure those EVs can reach profitability within 12 to 18 months under reasonable assumptions about volume and pricing. And timing is particularly important given the rapid pace of innovation. Moreover, they observe that ensuring the financial health of an EV program is key in its early stages, as issues become more challenging to fix later.

But the authors add that they don’t agree with the idea that the recent slowdown is a reason for automakers to pivot away from the EV race. They caution against over-extrapolating “the latest” auto sales mix trends into the distant future, noting lessons learned during the recession of the late 2000s. Another observation: The EV slowdown means the catalysts for the next leg of EV growth are arguably up for grabs. For legacy automakers, the cost-benefit analysis leans heavily toward attempting to drive the next round of that growth; if automakers wait until it’s abundantly clear that EV demand is back, chances are they’ll be left chasing the market again.

Existing Citi Research clients can follow this link to access the full report, which also offers in-depth looks at EVs’ prospects in Europe, China, Japan, Korea and India; key investing themes; and top picks.