The following is a freely accessible summary of a published Citi Research report.

A new report from a team led by Dirk Willer, Citi Research’s Global Head of Macro, Asset Allocation, and Emerging Market Strategy, looks at seven trends impacting asset allocation, from the need for hedging against inflationary shocks to artificial intelligence as a hedge for human capital.

1. 60/20/20 Is the New 60/40

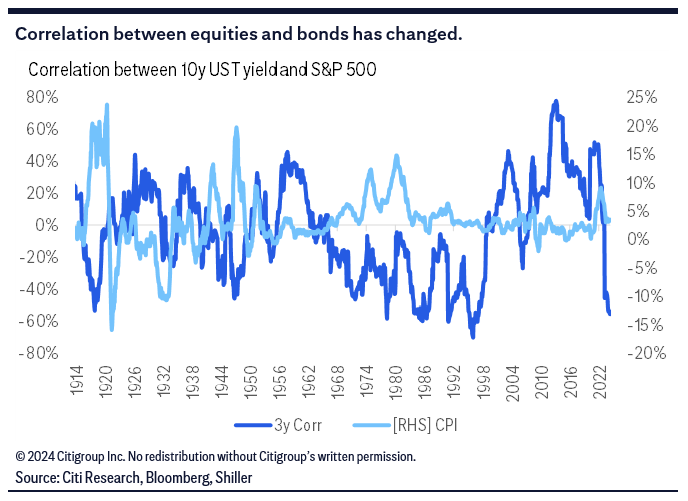

The authors point out that bonds only hedge deflationary risks, and the post-COVID episode was an unpleasant reminder that the typical 60% stocks/40% bonds portfolio offers no protection against inflationary busts. After a long period of positive correlations between U.S. bond yields and the S&P 500, we recently moved back into negative territory, which will likely impact how comfortable investors will be with the 60/40 portfolio going forward. Current real yields aren’t high enough to be competitive with equity returns, so large bond positions would also need strong hedging properties to deserve a 40% weighting.

Going forward, the authors note, it’s very unclear whether inflationary or deflationary shocks are more likely, with plausible narratives for both. Given that, a well-balanced portfolio needs inflation hedges, too—and an allocation should be closer to 60% stocks/20% bonds/20% inflation hedges than 60% stocks/40% bonds. Bonds still have a place in the portfolio but it’s a smaller one, with investors needing some space for hedges against inflationary shocks.

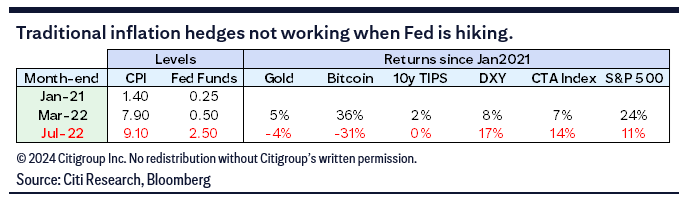

Willer and his team find that many traditional inflation hedges have protected against inflation that the Fed is less focused on, but not against inflation that the Fed cares about and addresses. Commodity trading advisor (CTA) and macro fund strategies are two hedges that have worked in either case. When inflation started to move up in early 2021, before the Fed hikes, gold, Bitcoin, Treasury Inflation-Protected Securities (TIPS) and even the S&P 500 did very well—these were classic inflation hedges that worked. But once the Fed started to react in March 2022, returns were negative for these classic hedges. What did work? The U.S. Dollar Index (DXY) and the CTA Index.

During periods of stagflation—when inflation is above average and growth below average—the best performers have been DXY and infrastructure. When the Fed hiked in 2022, gold didn’t help; that left the U.S. dollar as the key public market asset that was a useful hedge. Macro strategies were also good hedges against stagflation. Price-following, either trend or equity and currency momentum, tends to work well in such periods, and some carry strategies can do well when inflation is above average.

The rise and rise of government debt

The market capitalization of outstanding debt has been rising quickly, particularly where debt issued by governments is concerned. Governments have mostly failed to readjust budget deficits and debt issuance to pre-COVID levels, and there’s a perception that they will likely react to the next crisis with another display of largesse. So there’s no end in sight to the trend of higher debt, absent a market revolt.

The authors note an important issue when using market capitalization to determine neutral weights: The more a country issues, the higher its weight. Also, in aggregate, the more bonds that governments issue, the larger the weight of bonds in a market-cap-sensitive benchmark, relative to other asset classes. However, the larger the issuance, the more danger of a default, of inflating the debt away, or of financial repression. The weights in a market-cap-based index are therefore positively correlated with the risk of the bonds. So far, debt levels for most G10 countries have stayed low enough for credit risks to remain contained, but increased issuance raises questions of whether that will remain the case, with the UK’s gilt tantrum a potential early warning signal.

The authors note the opposite is true for equities. Strong buyback behavior and somewhat sluggish IPO behavior has led to a net reduction in outstanding equities. While market capitalization has been increasing largely due to strong price appreciation, there are no supply fears in equities.

Such arguments favor equities over debt for the medium term; in exploring the question, the authors see another warning not to rely on the hedging properties of government debt.

Going private

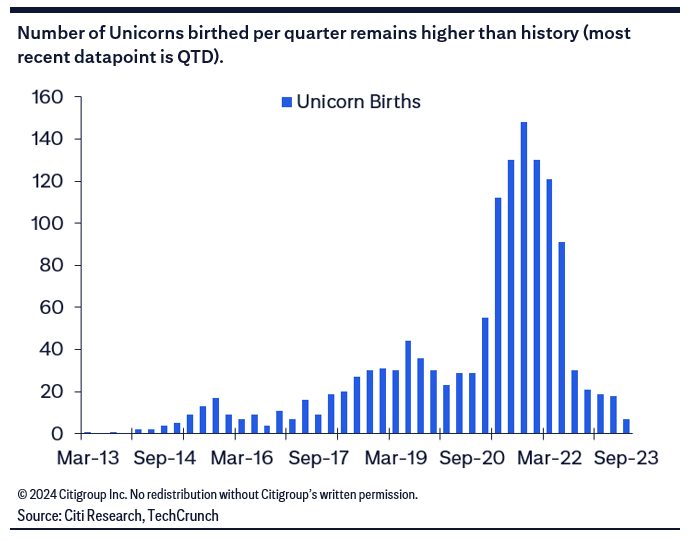

Private assets, and particularly private equity, have grown significantly over the past two decades. The authors note that such growth for an asset class would typically cause alarm bells, but they see this trend continuing for the foreseeable future.

The authors see structural changes allowing the relative attractiveness of private assets to continue. Immense capital flows into private assets have meant firms can stay private for longer, as witnessed by the elevated number of Unicorns, defined as startups that achieve valuations of greater than $1 billion. In the more distant past, the authors note, firms with a valuation above $1 billion would likely have needed to rely on public markets for financing, but now private markets can support their needs. If firms stay private for longer, more investors will be forced into the private asset markets, making it easier still to stay private for longer.

Companies staying private for longer produces a headwind for public market investors, as those markets are left with less alpha and more beta. That means stock pickers should want to be active in the earlier stage of firms’ development, suggesting even more capital flowing into private markets.

A spot for crypto?

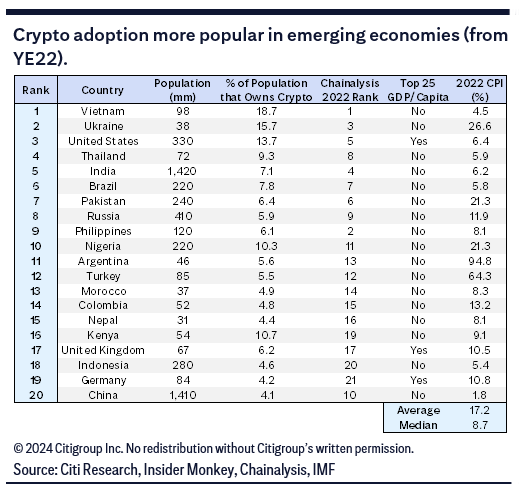

Many have argued crypto has zero inherent value, but markets certainly disagree, with market pricing providing evidence that there’s at least some value to a decentralized monetary system, as well as to blockchain and other emerging technologies. The asset class has survived a second “crypto winter,” which suggests it’s here to stay; the U.S. Securities and Exchange Commission seems to have reached the same conclusion, with a significantly lower risk of a regulatory onslaught.

So far, the use case for crypto has been more evident in emerging markets, where the risks posed by inflation, currency debasement and capital controls have made an alternative to the local fiat currency attractive, especially after 2022’s spike in global inflation.

But inflation isn’t the only driver of crypto usage; crypto has also seen high rates of adoption in lower-inflation emerging economies, likely reflecting demand for cross-border payments or a workaround for restrictive capital controls and limited banking assets. With inflation higher for longer and fiscal debt continuing to soar, investors who employ crypto might see it as a potential hedge against the more extreme cases of currency debasement.

The importance of macro

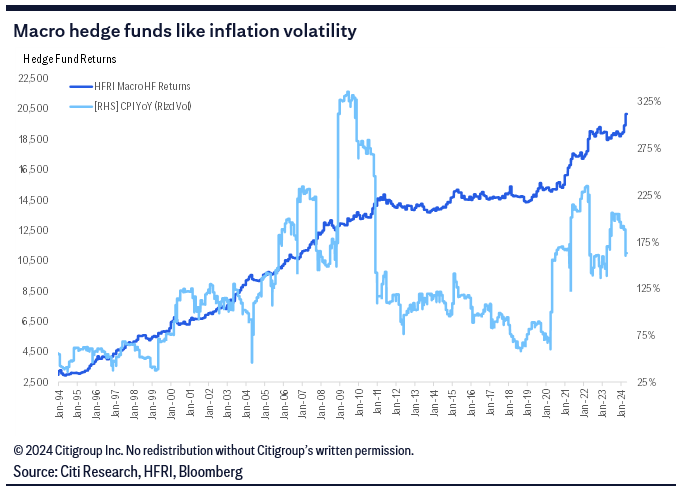

The authors note that macro hedge funds are one asset class that could benefit from more two-sided inflation volatility and the fixed-income volatility that comes with it. Macro funds have tended to do well when inflation volatility is rising or when it’s coming off sharply from high levels (though more poorly when inflation volatility is low and falling, as was the case in 2012 and 2020). In the past shocks were mostly deflationary, but they now look potentially much more symmetric, which suggests inflation volatility will remain relatively high.

The rise of friend-vesting

The authors note that much has been made of near-shoring and friend-shoring, which they call largely a euphemism for avoiding direct investments in China, as it’s both far from the West and a strategic competitor to the U.S. But they also observe that there’s a portfolio investment component to this development. From that perspective, the issue isn’t geographical proximity; rather it’s that friendliness matters more than it has before given the prospect of seized assets and sanctions between unfriendly nations. The point of no return in the thinking about friend-vesting has been the Russia–Ukraine conflict, which saw U.S. sanctions reduce the value of Russian securities held by U.S. mutual funds to nearly zero.

In theory, this new geographical environment would require a heightened risk premium priced into the relevant assets at the very least; in practice, the market is “notoriously bad” about pricing risks that don’t appear likely to materialize in the short term. That leaves investors with two strategies: act as if the geopolitical risk doesn’t exist until things change; or avoid investments in places antagonistic to the West.

Flows into and out of China’s government bond market are already showing signs of friend-vesting in recent years; the authors expect that to continue, and note that this geographic component of asset allocation is likely to grow more important.

AI as a hedge for human capital

Finally, Willer and his team explore artificial intelligence (AI) as an asset to which capital can be allocated. AI endangers a large number of jobs across many industries, with the International Monetary Fund estimating that 60% of jobs in advanced economies are exposed to AI, with the jobs negatively impacted and those seeing potential enhanced productivity about evenly split. While acknowledging that precise numbers are very unclear, the authors note it seems obvious that AI implementation will negatively impact many in the workforce.

Given that AI is a risk to human capital in this way, an investment in the AI-centric investment theme can serve as a hedge for human capital, with the optimal size of such an investment depending on many factors. The authors acknowledge that productivity gains could be positive and job-enhancing for some, but add that it won’t be easy ahead of time to know which jobs are safe.

Existing Citi Research clients can follow this link to access the full report.