Over the past decade, amazing progress has been made toward addressing climate change. In 2015, 196 parties adopted the breakthrough Paris Agreement at the COP15 meeting, creating a legally binding international treaty focused on keeping the rise in the mean global temperature below 2°C above pre-industrial levels.

At the COP26 meeting in 2021, world leaders assembled again to lay out a global agenda for a path to net-zero emissions, and they established an actionable framework around the promises made in the Paris Agreement. Once the plan was put together, the next challenge was figuring out how to pay for global action on climate change. Between 2016 and 2020, climate-related projects mobilized between $600 billion and $900 billion on average annually. However, to reach the IEA Net Zero by 2050 Scenario, an estimated $125 trillion is required over the next 30 years. Despite global finance flows more than doubling in 2022 to $1.4 trillion from 2020, the estimated annual climate finance gap between 2030 and 2050 is nearly 7x 2022 flows.

Investment progress in the energy transition is being made — in developed markets via private capital financing, and in emerging markets primarily from public sector capital and supranational organizations. To achieve already-established global climate goals, much of the climate finance in the coming decades will be in emerging markets. The challenge is to mobilize private capital with lower risk profiles to invest in higher-risk emerging markets that need funding for climate projects.

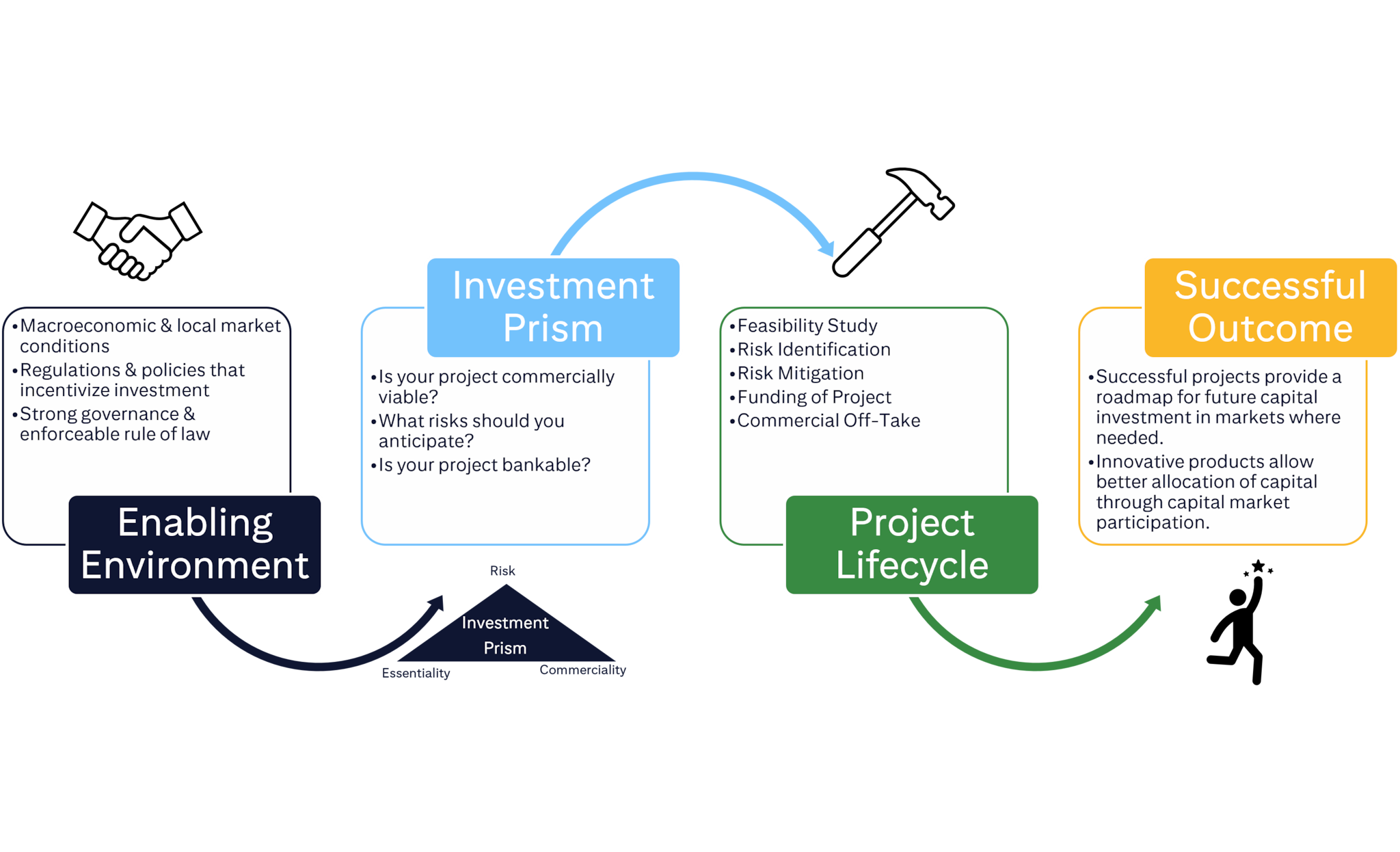

In this report, we lay out a framework for the development of “bankable projects” that relies on stakeholders to building an understanding of the challenges facing each party by creating an enabling environment, looking at projects through an investment prism, developing a project lifecycle, and delivering successful outcomes.

What this means in practice is each stakeholder doing their part to bring very much needed climate finance to emerging and developing markets. For public sector this means developing a stable and predictable political and economic backdrop while also intentionally setting a climate agenda. Government officials should work with multilateral development banks (MDBs) development finance institutions (DFIs), and importantly the private sector, to prepare complete feasibility studies that further their climate agendas. MDBs and DFIs know that they are a major contributor to the mitigation of risk and their ability to reform their frameworks for capital deployment, among other calls will be key to the success of scaling in new markets or technologies. Private sector corporates and financial institutions also play a role; their ability to understand risks, markets, and the immense opportunities ahead is imperative.

The hard part of the energy transition is mostly done — there is a will to invest in projects, and there is capital to fund those projects. Bridging the gap and releasing the flow of capital is the next step.